Many voices.

Together we strive toward a single goal

We invest in high-quality small and mid-cap businesses that have impressive management teams, low leverage and demonstrated records of consistent growth.

We engage in fundamental analysis to identify these companies through a single focused approach.

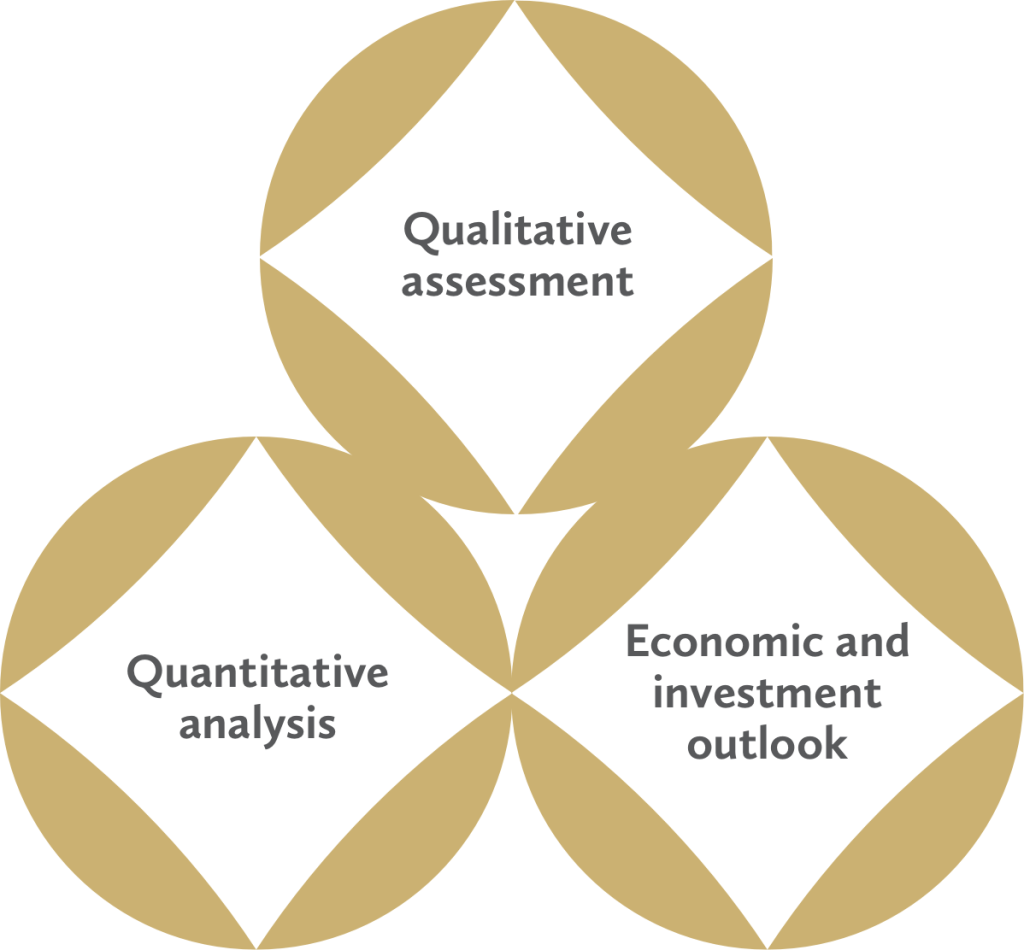

Qualitative assessment

of market leadership and long-term competitive advantage

Quantitative analysis

of financials and projected growth

Economic and investment outlook

to determine relevant macro trends

We believe investing in proven, high-quality companies leads to competitive returns with below-average risk over the market cycle.

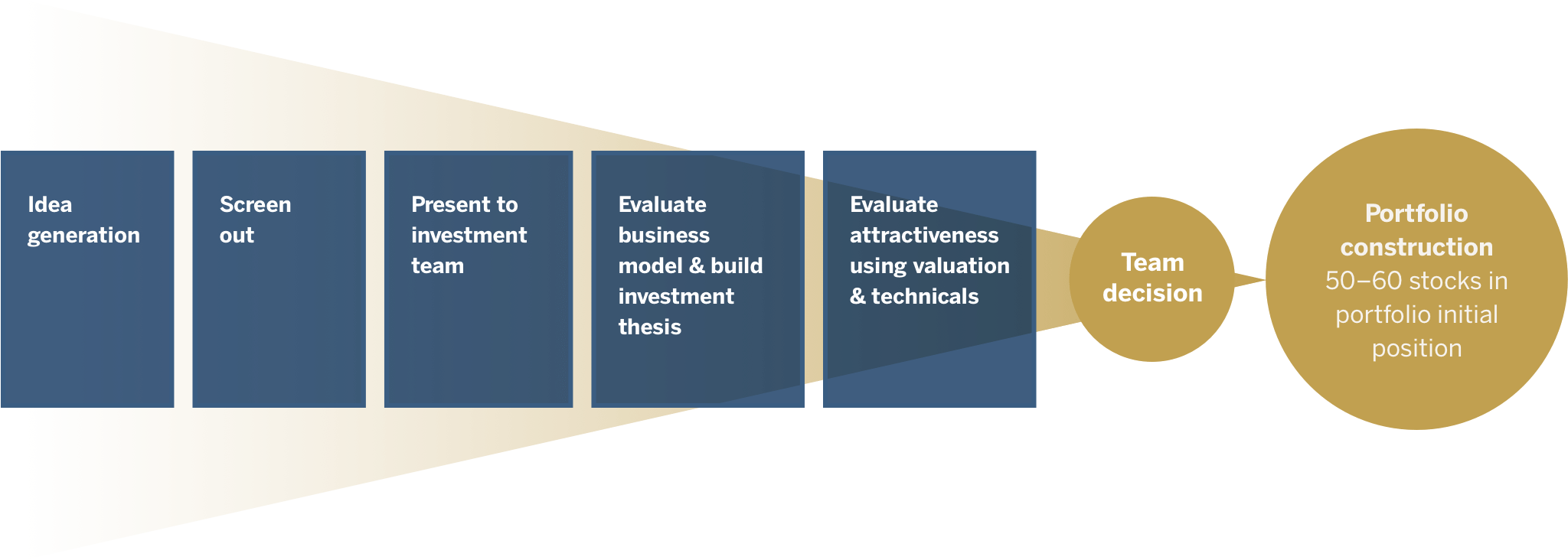

The experience of our people, combined with our culture of teamwork, open dialogue and accountability, fuels an investment process that has stayed consistent since our inception in 1987.

Market outlook

Download our latest analysis of market trends.

Both institutional and individual investors benefit from our disciplined approach.

Institutions

Because we invest in our own strategies, our priorities are aligned with yours. We stick to our high-quality philosophy, even if we’re not rewarded in the short-term.

High-net-worth individuals

Our portfolio managers forge long-term relationships and communicate proactively. Our goal is always to protect and grow your assets.

Our strategies

Generally within the range of the Russell 2000® Growth Index, these companies tend to be smaller dynamic growers with strong profitability, which allows them to fuel their growth prospects.

Our SMID strategy harnesses the best ideas from our small-cap and mid-cap portfolios to create a high-conviction, best ideas portfolio.

Our Mid Cap strategy focuses the majority of assets on companies in the Russell MidCap® Index. Mid-cap companies are unique in that they are more stable than small-cap but can provide more exciting growth opportunities than large-cap.

Offering the broadest range of stocks, our All Cap strategy combines the higher growth potential of our small- and mid-cap strategies with the added stability of larger, more mature companies.